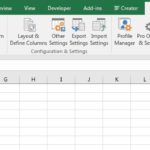

The IIF Transaction Creator converts worksheet data into IIF files for import into QuickBooks. It integrates with and is used from within Excel.

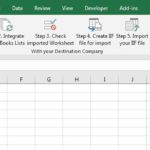

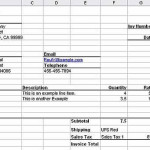

To use the IIF Transaction Creator, arrange your data in row/column layouts on a spreadsheet. Several layout options are supported including a simple single-row layout and more complex multi-row layouts that resemble a QuickBooks Journal report. Examples are available from the IIF Transaction Creator’s menu and can be used as templates.

Most QuickBooks transaction types are supported for import. Using the IIF Transaction Creator, you can import these types of transactions:

Download the IIF Transaction Creator for a free trial before you purchase. You can use the fully-working trial to export up to 100 financial transactions to IIF files for import into QuickBooks (e.g. 100 checks or 100 invoices, or a mix of transactions.) This is the only trial limitation.

The IIF Transaction Creator includes examples for the various supported transactions. You can access these from the Examples menu once the IIF Creator is installed. You can use these examples for all of the transaction types listed above. Examples can even be pulled directly from your QB file for review in Excel, so you can see how your accounting and other field values should look in Excel.

We’ve also provided a few extras in the form of templates that you can use on their own or with the IIF Creator. See the template workbooks page for useful extended templates. Use these for additional ideas / different ways to use the IIF Creator. These specialized templates include an expense report, invoice, journal entry template, a depreciation calculator, and a loan payment calculator.

Release Notes

Review changes – most recent builds first

Upgrade to the latest build!

12.04: Changes:

- Resolve case where “Unspecified Customer” or “Unspecified Vendor”was added to the names list when importing single row A/R or A/P transactions like Invoices and Bills.

- Add logic to the code that calculates the due date based on the Terms record used on A/R and A/P transactions so that terms types don’t get confused. This specifically helps with terms like “Due on receipt” which should set the due date to the invoice or bill date.

- When marking sales transactions to email from QuickBooks after import, prevent an incorrect check worksheet warning saying that a new customer does not have an email address when they do, which happened when when they were used on two or more transactions marked to email.

- When adding new Customers and Vendors, add the Terms used on the transaction to the name record.

- Add instructions to the documentation for creating the QuickBooks Online Journal report to use with the IIF Creator – support for which was added in 12.03.

12.03:

- Handle rare case where a General Journal transaction has a blank first row.

- Add support for the QuickBooks Online Journal report, which can now be used to create IIF files for import into QuickBooks Desktop with little modification.

12.02: Fix a case where code that updates the various layout options doesn’t work as it should (an Excel bug it seems) – on some computers.

11.99: Fixed an issue that caused terms records to not be loaded properly, which in turn caused invoice due dates to not calculate based on the terms.

11.95: Changes to work around Malwarebytes uppity false positives.

11.93: Changes to the Layout & Define Columns window to avoid unwanted messaging related to account columns when changing layout styles.

11.89: Layout changes to the About & Purchase window.

11.86: Renamed some menus and ribbon buttons for clarity. Changes to the installer to make it clear Excel 2016, 2019, 2021, and 365 are all supported.

11.84: Fixes to name matching so that names and name account numbers that are numbers with leading or trailing zeros will match more reliably. Properly recognize customer taxability settings when integrating lists using an IIF file.

11.83: Check the server for new builds only once per day. Fixes to the auto-calculate sales tax feature so it won’t miss the last transaction on the worksheet. Add support for auto-calculating sales tax for the single-row transaction layout style. Add Support button to the About & Purchase window. Slight layout changes on the About & Purchase window.

11.81: Improve the “check for updates” button on the Ribbon which will now tell you when there is a new update. Improvements to support-related information added to IIF files.

11.79: Fix a compile error introduced in 11.78!

11.78: Better handling for keys when a space is omitted from the name portion of the key. Changes to the way connection errors are added to the IIF file for support review to prevent over-zealous warnings from QuickBooks.

11.77: When using the multi-amounts layout style, now use the worksheet memo for each line item first, and then use the item’s memo only if the worksheet memo is empty.

11.76: Handle a case where an invalid Terms record was causing the IIF Creator to hang when trying to calculate the due date.

11.74: 20x performance improvement when reading integrated names before using the Check Worksheet or Export to IIF features. Consistently preserve list field values that look like numbers but really are not, like 00123 or 1000.0000, which previously might have been saved as numbers like 123 or 1000, losing their formatting.

11.73: Now use the item purchase memo/description for purchase transactions if no description is provided on the transaction worksheet. Resolve “compile error in bMod” and related errors introduced in 11.69 by removing a reference to a component that doesn’t exist on some computers.

11.72: Resolve issue introduced in 11.69 that caused a “Microsoft Forms” error on some computers. Improve performance when integrating via an IIF lists file using the new partial integration option where the names list is very large.

11.69: When new items are found in Excel on transactions on purchases (like checks or bills) add the account and the item price to the cost side of the item instead of the sales side. Use the default income account on the sales side.

11.68: When integrating lists, can now blend the Direct Connect and IIF Lists File methods, which will help with QuickBooks 2022 & newer versions because they will not integrate the items list. When integrating via an IIF file, can now choose an option to only update the lists that are in the IIF file! Integration complete window reworked and now includes status for the Terms list. When integrating via an IIF file, better handling for Assembly items. Update main documentation and the List Integration help file available from the Integration window.

11.67: To better handle non-sales transactions, don’t automatically select a sales tax item to use when the sales tax account is used and no sales tax item is specified.

11.66: Better handling for name list record fields that contain values that look like numbers but are actually text, including name and address fields as well as custom fields and terms.

11.65: Fix a compile error related to changes in 11.64, managing the output file locations when import a DAT settings file.

11.64:

– Handle special characters when passing information to prefill the support request form.

– Improve handling of key date fields when pulling transaction data from QuickBooks.

– Detect the computer’s system date format and use it for display in the About & Purchase dialog.

– When importing settings, manage output file locations if the saved location does not exist on the current computer. In this case, default to the Documents folder.

– Handle product keys that include embedded quotation marks (which is rare).

11.63: Fix a case that caused Excel to hang when attempting to integrate lists. This happened rarely, on computers where trying to read the windows registry resulted in a system error. Also, now display the error.

11.62: Now add the fully-qualified class name when specifying only the sub-class name on a worksheet. Handle the import of very large settings .dat files. Add some special handling for particular settings.

11.61: Refinements to changes made in 11.59. Update the single-row multi-amounts layout style example to include the Taxable column and related help text. Changes to values written for sales tax rows so that the auto-add and auto-calculate sales tax features write the same field values as when tax lines are included on the worksheet. Change so when adding older product keys on a new installation the Good Through date is set (instead of displaying “‘———-“).

11.59: Add check for updates button to the IIF Creator’s custom Ribbon tab for newer Excel versions and to its custom menu for older Excel versions.

11.58: Updates to the support request window and to error messaging around adding product keys. Add icon to Ribbon to check for product updates.

11.57: When calculating due dates used on A/R and A/P transactions, handle case where terms based on the day of the month have the day set to 0 in QuickBooks, which notably isn’t a day of the month.

11.56: Improve QuickBooks version detection and connection from 32-bit and 64-bit Excel when connecting to both 32-bit and 64-bit QuickBooks versions.

11.55: Changes to avoid the error message “Unexpected error; quitting” from a QuickBooks 2022 component that’s only partially installed.

11.54:

– Improvements to logic when auto-setting the transaction type when no type is specified or an invalid type is specified.

– Updated messaging when the QuickBooks version can’t be detected before integrating.

– Updated messaging when the connection to QuickBooks fails, offering new suggestions.

– No longer use an account or a rate when creating or using Subtotal type items.

11.53: Improve code that detects the running version of QuickBooks before connecting to integrate lists.

11.52: Enhancements for QuickBooks 2022 support.

11.51: Add support for QuickBooks 2022 and Enterprise 22.0.

11.47: Rework automatic due date calculation for purchases and sales that use terms. Improve handling for date driven terms.

11.45: New option to ignore the QuickBooks document number field length limits and import up to 20 characters, which are visible in reports but not on most transaction forms. Add messaging to status-bar when checking for a broken QuickBooks connection – useful when it takes a few seconds.

11.44: New feature to try to detect and repair a broken QuickBooks connection with no need to re-run the installer.

11.41: Force the selection of the New Transaction column if it’s mapped to another name. Fix related issue that caused the column values to be ignored when accounts were set in preferences and not listed on the worksheet in columns. Fix code so the DataLayoutHelp.doc is opened from the buttons that call for it. Update text on ‘missing columns’ dialog window that can appear when checking data and exporting to an IIF file.

11.39: Now only recognize and use columns that contain accounts where the columns are appropriate for the selected layout style. Reword prompt that asks if the last IIF file was successfully imported.

11.38: Several improvements based on customer suggestions related to Sales Tax: The IIF Creator will now automatically calculate sales tax and then adds it to transactions using each customer’s default tax item (previously it would add the tax but not calculate it.). Automatic tax calculation now uses both the customer’s and item’s taxable status when calculating the sales tax. If you overwrite the tax rate for a tax group, all the items within it are pro-rated to match. Add a new “TransTaxable” column, related to sales tax. Updated examples to show use of the new TransTaxable column. Update Sales Tax section in documentation to match changes.

11.37: Revise the AutoTax feature and document it. Document the “AutoCalc amount” feature, which lets you enter a “?” in amount fields for transaction rows and then the amount will be automatically calculated. Fix an unreported integration issue with group items and sales tax groups where their details would be lost and not automatically added to the IIF file.

11.36: No longer put up a notification when there are extra columns on the worksheet, as that caused confusion and extra columns are just fine. Fix Payment transaction example worksheet so the Amount is the correct sign. Correct the name for the Transaction Account column when pulling transactions from QuickBooks as examples. Similarly, fix detail row only example fields that were being cleared incorrectly. Now, when pulling transactions from QuickBooks as examples, enter any date range desired instead of just the last 5 days.

11.35: Make sure account numbers, which are not really numbers, are treated like text.

11.33: Fix an issue handling integrated lists where records include multi-row text fields.

11.32: Add option to retain integration temp files for support review.

11.31: Major update!

When an in-product link to our site can’t be opened for some reason, now display a message with the link that can be pasted directly into a browser.

When checking the worksheet, no longer look for new Items on transaction total rows – since they (correctly) won’t actually be included in the IIF file. For example, the Bank account row of a Check cannot accept an item, nor can the Accounts Receivable row of an Invoice.

For new name records, now format address fields that contain double-quote characters so the double-quotes can be imported.

When using the single row multiple amounts layout style, now define up to 100 Detail Rows, up from 10, using the Configure Amounts window’s pick lists.

When using the single row multiple amounts layout style, now automatically push sales tax rows to the end of each transaction in the IIF file. Now the order of the Detail Row definitions for sales tax no longer matters.

Significant refresh for most dialog windows to aid in usability.

Add tool-tip text to many fields in the Layout & Define Columns dialog window.

Update default field names to match newer versions of QuickBooks. Older versions of the names still work.

New option, now the default, to use a more reliable method to process temporary files returned from QuickBooks when integrating lists – in order to handle unusual text characters in the files.

Refresh all help files with cleaner language, streamlined formatting, updated screenshots, and more thorough coverage of settings and preferences.

11.29: Add option to skip hidden rows when exporting to IIF! Default to parsed address option when no option has been set. Updated support information written to IIF file. When pulling example transactions from your company file, now match the example address to the selected address type option (parsed or block addresses). Fix issue where new names were counted multiple times when error checking the worksheet when the names list is very large.

11.27: Make sure older annual keys work properly with newer primary keys. Better alert messages when subscription is due or overdue. Add warning to delete key message to explain that it’s unusual to delete keys. Reorganize the IIF file export form for clarity.

11.26: Better handling for new names and the default customer name for sales when AP, AR, and the special sales tax accounts are used.

11.25: 1) Sales Tax related change: Now use the account from the sales tax item and then if not found use the special sales tax account QB creates, instead of the other way around. 2) Handle key entry case where the space between the first and last name is omitted.

11.24: Resolve issue for sales tax for QB Canada where the tax rows were written to the IIF file without an account.

11.23: Resolve issue introduced in 11.22 that resulted in a run time error when attempting to add an Annual product key.

11.22: Better handling for sales tax when new tax items are used on the Excel worksheet or when incorrect accounting is used.

11.15: Fix issue where new parsed address fields that use custom column titles were not found during export.

11.11: Handle case where Excel worksheet is corrupted and Excel indicates there is only one row of used data. Handle case where account numbers (which are really text) change when stored as numbers during integration.

11.08: New example layout guiding message. Fix issue related to picking a layout style where wrong style was used to create the IIF file. Fix auto-calc issue for amounts and price each fields when in single row mode.

11.06: Rework message that prompts user to choose a layout style. Remove the option to auto-detect the layout style due to usability and code complexity issues.

11.04: Revamp address handling and column/field mapping. Now, choose between block address rows or individual address fields like Street, City, State, and ZIP. Also, now you can “map” your worksheet column names for all address fields, giving you more control.

11.01: Improve handling for default transaction types when none are provided in preferences or on the worksheet being processed.

10.99: Ensure the Integration dialog appears before exporting to an IIF file.

10.97: Improve double-quote handling for text fields.

10.96: Improve handling of billable status field for line details on the Items tab on purchase transactions.

10.93b: Changes to installer related to repairing the QuickBooks connection.

10.93: For better list matching, now retain double-quotes for text and list fields instead of replacing with two single quotes.

10.91: Resolve OLE error caused by attempting to open the documentation when it’s already open.

10.89: Better handling of integration data when QB user doesn’t have sufficient rights to pull lists properly.

10.88: Changes to installer and key handling code in the About dialog.

10.84b: Update to installer to better detect QuickBooks installations.

10.84: Significant performance improvements while integrating with QuickBooks – especially for larger files.

10.81: Improve code that saves and gets the user-specified temp file location.

10.79: Add Paste button to key entry dialog for convenience. Rework messaging when keys are entered incorrectly or for the wrong product.

10.78: 1) Add option to set the temp folder used when pulling data from QuickBooks in order to handle the case where the user does not have rights to their own temp folder. 2) Add warning at startup if creating the custom Ribbon tab is not possible because user does not have rights to the customization file. 3) Add smarter transaction type defaults to be used when no type or an invalid type is specified.

10.77: When using the insert account feature, the selected account is actually copied to the worksheet.

10.76: Update list integration code to handle cases where tabs are included within data fields.

10.75: Changes to support info added to IIF files, to logic regarding when to auto-pop the integration dialog, and to capture the QB file information when pulling example transactions and integrating lists.

10.74: When inserting names, items, and classes, and the record can be interpreted as a date (e.g. “April 2020”), prevent Excel from converting it to a date. Updates to the connection dialog with better advice for IIF file integration.

10.73: Now correctly handle group sales tax items when “auto-adding” sales tax to sales forms.

10.72: Fix issue where Jobs were not included on Purchase Orders. Minor updates to connection dialog tips.

10.71: Add “Insert” section to menu for older versions of Excel (to insert Accounts, Items, Names, Classes from QuickBooks as well as and Data Fields on your worksheet.) When typing in the insert dialogs, now auto-match text within a record when no item starts with the text entered.

10.66: Improvements for single-row examples & changes to advise on connection dialogs.

10.65: Update code that creates new items to use the correct account column for various layout cases.

10.63: Improve layout of the examples dialog window. Improve error checking & related messaging for missing required fields.

10.62: Allow up to 20 digits for A/P transaction document number (11 for other types of transactions.)

10.61: Add option to Options & Settings dialog for current session right click insert menus for all Excel versions. Set and correctly display good through date in About dialog for certain upgrade paths.

10.58: Update the text file import date handling for cases where your text file date formats don’t agree with your or computer’s date format.

10.57: Include Cost of Goods Sold in the list of account types that can be marked billable on purchase transactions.

10.56b: Installer update related to integration issues specific to 32-bit computers.

10.56: Clean up behavior when defining multi-amount transactions.

10.55: Change the way check worksheet results are copied. Better messaging when entering a key for the wrong product.

10.53b: Installer update related to integration issues.

10.53: Resolve QuickBooks integration issues with recent QB patch releases.

10.52: Detect recent QB releases while integrating to avoid QB crash.

10.49: Reorder ribbon buttons to put examples in the help section.

10.47: Change so that when the new transaction column title is the same as the values on transactions the first transaction will be included in the IIF file.

10.46: Enable default transaction types based on transaction totals for the single-row multi-amounts layout. Prevent unneeded names from being added in the single-row multi-amounts layout

10.45: Update for setting reimbursable status on purchase transactions for QB 2019.

10.43: Update to integration error handling – pass back original error message & update suggested actions.

10.42: Remove code that truncates document numbers – originally added for QB 2019.

10.38: Better handling of transaction cleared status values, better default account values (and new settings for default income and expense accounts), as well as smarter default accounts for new inventory items.

10.37: Fixed issue where Annual product keys were sometimes not displayed.

10.33: Dialog window changes to link customers to QB 2019 import recommendations. Tweaks to the file format.

10.32: Fix error with insert list record feature that caused an error if there were no integrated lists.

10.31: Changes for QB 2019 (more!) including new help links.

10.29: Additional changes for QB 2019. Date fix for some international locations.

10.28: Changes to purchase transaction handling so that item and non item rows will appear on the correct tabs in QuickBooks.

10.27: Fix issue with mapping dialog that caused lists of records to match to be empty.

10.26: Changes to accommodate QuickBooks 2019 and Enterprise 19.0

10.24: Updated example templates to address more common questions and display additional columns. Revised notes.

10.23: Changes to the column mapping dialog to help prevent invalid Account and Amount field selections. Updated documentation.

10.22: Significant changes to the custom menu and Ribbon, and also updated the documentation to match.

10.19: Changes to About & Purchase dialog to handle more than one product key. Fix for Excel 2016 to resolve issue where app would not load properly.

10.18: When adding a Job to an existing customer, copy various contact information from the customer.

10.17: Now when mapping the Account column to nothing, the default name “Account” is not used. This helps when the “Account” column on a worksheet is used for a customer or vendor account and not a GL account.

10.16: For the single row multi-amount layout format: Now when no other account is found the amount column name is correctly used for the transaction detail row.

10.15: Now capture name addresses when specified for detail transaction rows. Also, when adding a job to an existing customer, use the customer address if no job address is specified on the worksheet.

10.14: Changes to the way integrated group items are stored in the list cache to handle larger groups.

10.07: Set newer 64-bit connection method as the default method. Also some minor bug fixes