Create Direct Debit NACHA files from QuickBooks – files that order payments from your customers – ready to submit to your bank

overview

Create NACHA files containing Direct Debit orders requesting money from your customers.

Note: To send money to Employees and Vendors (any name, really), use our Direct Deposit file Creator.

The Direct Debit file Creator integrates directly with QuickBooks and is available from the QuickBooks Banking menu.

Use it to create NACHA files containing payment orders – payments from your customers – using payment and sales receipt transactions recorded in QuickBooks with the “ACH” payment method.

It creates NACHA files that are ready to submit to your bank. (NACHA files are specially formatted text files that contain ACH payment data. Many banks will accept these files directly.)

How it works

The Direct Debit file Creator searches for payments and sales receipts in your QuickBooks file for customers who have been configured with bank routing and account numbers entered in a special custom field. It uses the payment amounts to create a NACHA file that contains payment orders requesting money from your customers – also called demand debits.

A printable summary report includes the number of orders and the total dollar amount of the orders included in each NACHA file created.

Benefits

There are several key benefits/features to using the Direct Debit file Creator:

Integrate seamlessly with QuickBooks.

- Choose options to match the way you record your Payments and Sales Receipts in QuickBooks.

- Create NACHA files that will group payments in daily deposits or deposit them individually.

Save Money

- Compared to accepting Credit Card payments, ACH orders are typically very inexpensive. They are usually just a few cents each no matter the amount of the payments.

- Pay only your bank’s fees when submitting NACHA files, if any. Some banks offer NACHA upload to business customers no charge, and others charge a small amount per ACH order.

Create orders with no additional data entry

- Create orders from your payment and sales receipt transactions.

- Transactions using the special “ACH” payment method are included in your NACHA file.

Bank account numbers for your ACH orders are stored on your customer records and are pulled automatically from QuickBooks along with your payments

- The instructions include steps to add the bank account data to your customers.

- When processing orders from your payments, the app will warn you if custom bank account data is missing or incorrectly entered.

Create Prenote NACHA files

- Some banks suggest Prenote files so they can confirm that the recipient bank information is correct.

Multiple bank & company Files

- Use with as many company files as needed. There is no per company charge. Configuration information such as bank and routing numbers are remembered per bank account, so you can create NACHA files for multiple accounts, either in one company file or different company files.

Free Trial

Click above to download your trial. Then install the app to start your free 30 day trial. The app is fully functional during the trial period.

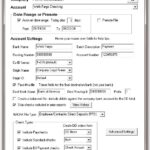

Screenshots

Release Notes

Review changes – most recent builds first

Upgrade to the latest latest build!

1.15: Rename ACH Payments Creator to Direct Debit file Creator. Update documentation and messaging.

1.12: Add support for QuickBooks 2022 and Enterprise 22.0 and newer 64-bit QuickBooks versions.

1.09: Fix the batch total check sum where there are multiple batches.

1.08: Fix an issue where the summary record at the end of the NACHA file showed a negative amount.

1.06: Update the Backup menu items.

1.05: Make sure the customer name is included for each payment. Use the internal QB customer ID as the customer ID.

1.02: Initial release