Create NACHA files using your QuickBooks data which are ready to submit to your bank. NACHA files are specially formatted text files that contain direct deposit data. Many banks accept these files directly.

The Direct Deposit File Creator integrates directly with QuickBooks and so can be launched directly from the QuickBooks Banking menu.

Use it to create Direct Deposit payment orders to send money to employees, vendors and other types of names, based on the paychecks, checks, and/or bill payment checks you’ve created in QuickBooks.

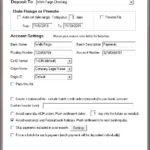

The Direct Deposit File Creator combines checks from QuickBooks with bank routing and account numbers entered on your employee and vendors records. Using this data it creates a NACHA file that contains your direct deposit orders.

A optional summary report can also be created with each NACHA file, which you can file or print. It indicates the number of orders and the total dollar amount of the orders included in the NACHA file.

After creating a NACHA file, then submit it to your bank for processing.

Click above to download and then install the Direct Deposit File Creator to start your free 30 day trial. The Direct Deposit File Creator is fully functional during the trial period, so you can try before you buy!

There are several key benefits/features to using the Direct Deposit file creator, when compared the direct deposit features within QuickBooks:

Release Notes

Review changes – most recent builds first

Upgrade to the latest latest build!

2.17: Fix a small layout issue related to the ‘smush’ feature. Don’t force the company name to be upper case on batch header records.

2.16: For Corporate Payments (CCD) ACH files, now optionally set vendors to ‘Corporate’ status using a custom vendor field – useful if the standard Vendor Type field must be used for another purpose. Changed messaging and instructions to match new option.

2.15: Now refresh the license status on the main window after being prompted to update the license and after entering a new primary or annual key.

2.14: Improve the logic for the “Avoid same day ACH deposits” option: Now, only banking days are considered when calculating the starting date and the number of days required to push the dd orders to avoid ‘same day’ charges. When pushing orders in this way, the resulting date will always be a banking day. Add Juneteenth, June 19, to the list of Federal Bank holidays.

2.13: Cast the Company Name field in batch header records to upper case, following the NACHA file requirements. Many banks don’t care, but some do.

2.12: Handle the case where the custom direct deposit “Bank” fields on employee & vendor records incorrectly include spaces between the values.

2.11: Updates to status messaging to not count 0.00 net check amounts as skipped. Rework startup so that fields are consistently disabled or enabled based on saved settings.

2.10: Changes:

- Improved error messages related to custom Bank fields used to store banking information – the cases are now more specific and accurate.

- Improved contents of the Direct Deposit File Results review file which is optionally created each time a DD file is created.

- Moved option to create the Direct Deposit File Results file to the main window under the output file name for better visibility.

- Catch case where the integration with QuickBooks fails on startup – prevent a DD file from being created when that happens.

- Make sure the company’s Routing Number is 9 digits long and passes the routing number checksum test.

2.08: Changes:

- Now account settings are saved per company file and per account within the file.

- Related, now if you change a bank’s account name on your chart of accounts, the DD file creator will continue to associate your settings with that account based on its internal ID.

- Display the current company file’s legal name on the main window above the bank account.

- Reorder the priority of different messages that can appear near the top of the main window, such as when there is a new build available or when the license is expired.

- The “skip prior checks” and “skip prior prenotes” options are now account-specific.

- Use more robust code to determine the temporary file path used when getting data from QuickBooks.

2.07: Changes:

- Add messaging to the main window to notify when there is a new build update.

- Add Good Through date and subscription status messaging to the main window.

- Improve status messaging when getting and processing data from QuickBooks.

- Improved messaging on the About & Purchase window.

- Clean up values sent when creating a support request from within the product.

- Make sure the license lasts through the good through date.

2.05: Improve messaging for QuickBooks connectivity, bank account selection, and regarding the output file location and file name. Now when selecting the option for a custom “origin ID”, use it even if it’s blank.

2.04: Changes:

- Add new (super amazing!) results file, named “Direct Deposit File Results.csv”, which is optionally created each time you create a NACHA file. It details the DD batches & orders that are included in the NACHA file, as well as those that are excluded, and for each excluded order indicates why it was excluded.

- While creating a DD file, all warning & error messages can now be ‘muted’ after they’re first displayed. Even when warnings are muted, the impacted DD orders are still added to the new review file.

- The success message that appears after creating a DD file now always stay on top of the main window and also includes a note about the new “Direct Deposit File Results.csv” file.

2.03: No longer force the company name to be upper case. No longer force payee names to be uppercase. Add option to in the Advanced Settings to cast names to uppercase.

2.02: Make the About window stay on top of the main create DD file window – so it doesn’t get lost.

2.00: Rename Help menu to Help & Support. Prefill more values in the support form after picking the Support Request from the menu.

1.99: Better handling of key settings when importing a settings file – especially from another computer. Updated code that sets the default file name and location to more reliably pick the Documents folder as a default location when no location has been specified or when the location is invalid. Centralize code that displays the product name in messaging.

1.98: Changes:

- New option to create DD orders for check totals when the check number is an actual number (not alpha numeric). Updates to addenda record formats for bill payment checks and paychecks.

- Now use standard NACHA file formatting with a * between fields and a \ after each logical record.

- Updated documentation to include these new features.

- Small changes to code that detects the running QB version to avoid an apparent hang in the rare case where attempting to read settings from the windows registry causes a system error.

1.97: Fix for “not responding” case when importing a very large settings DAT file.

1.96: Big update! Changes to improve QuickBooks version detection, to help avoid the “Unexpected error; quitting” message from a partially installed QuickBooks component. Add “check for updates” to the help menu – which brings you here! Changes around key entry to clarify reasons for rejecting incorrect keys. When starting a support request from the help menu, pass information to pre-fill support request form such as the product build and key. Layout changes to the About & Purchase window.

1.93: Update forms so various fields and backgrounds will now appear white in all cases. New option to set form resize ‘smush’ percentage for lower resolution monitors.

1.91: New error checking and messaging if a payee’s routing number doesn’t pass the standard checksum test (and so must be invalid). Reworked setup error messaging for clarity. Fixed layout issue with success message that caused the buttons to be covered up by the next step text.

1.89: Add support for QuickBooks 2022 / Enterprise 22.0.

1.88: Correctly set addendum record count.

1.87: Add ability to use a custom addendum record terminator. Correct batch record counts when addendum records are added to the file.

1.85: Only get the vendor and customer records when they are needed – when check types that use them are selected. Update function that opens the documentation. Refresh registered status after entering product keys so restart isn’t required.

1.84: Better messaging when adding/deleting keys. New button to paste key from the Windows clipboard. When entering key to unlock trial, refresh the main form to show that the tool is registered without the need to restart.

1.83: Add option to set the batch header’s “company discretionary data” field value.

1.82: Add “Resize” menu option with the ability to shorten the main window to fit lower resolution monitors.

1.81: Improvements in messaging. When upgrading from an older version that didn’t have the option, don’t default the new “Creator DD orders from:” option to anything, so the user can pick. Double-check to make sure the “Creator DD orders from:” is selected.

1.79: Update calculation for batch entry hash to reset each batch.

1.78: Additional messaging for skipped checks – skipped because the net check amount is 0.00 when only exporting “Check Amounts”.

1.77: Improve messaging for cases where no transactions that can be processed into DD orders are found. Now give specific advise based on selected options for the types of checks and where to look for DD orders.

1.76: Major update:

- Now you can choose to include NACHA Addenda (voucher/memo) records. They include the pay period for paychecks, the bills paid for bill payment checks, and – optionally – transaction memos.

- Explicitly include or exclude paychecks, standard checks, and bill payment checks in your NACHA file.

- New option to create a DD order for the net check amount that requires minimal set up. No need for special items or accounting.

- New option to “sweep” the remaining net check amount when using DD items, so you can include several DD orders that leave a remainder and automatically send that remainder as another DD order.

- Added to and clarified messaging for the report that is generated each time a NACHA file is created.

- Updated user interface with new Advance Options dialog.

- Updated documentation to match changes.

1.72: Changes to the installer regarding QB integration issues. Updates to messages regarding entering product keys.

1.71: Set and correctly display good through date in the About dialog for certain upgrade paths.

1.70b: Resolve QuickBooks integration issues with recent QB patch releases.

1.70: Fix messaging and display issues around entering product keys.

1.69: Add Contractor Only option, which doesn’t require the QB user to have payroll rights. Added section to documentation describing specific rights required to use the app with QB – if you’re not using the QB Admin log in.

1.68: Added a warning message if a temp file for support can’t be created.

1.67: Change to create the temp files for backup before processing each data type instead of after.

1.66: Changes to About & Purchase dialog to handle more than one product key. Add options to create a batch per DD order and to use the Payee as the batch description.

1.65: New option to automatically avoid weekends and federal bank holidays. When selected, checks dated on these dates are pushed to the next valid banking day.

1.64: Change to enable standard checks for employees. Previously only paychecks were allowed for employees.

1.63: Dialog changes for clarity.

1.62: Several changes to code for pass thru files.